The recent stock market volatility, triggered by President Donald Trump’s tariffs and the resulting trade tensions, has sent shockwaves through the global markets.

Understandably, investors are rattled. But it’s important to look through the initial noise, to hold your nerve, and to continue to make strategic investment decisions.

Economic shocks and market fluctuations are a normal part of long-term investing, and your financial plan should be designed with these bumps in mind.

Bear with the market

There are fears that Wall Street could soon be in the claws of a bear market, driven by the escalating trade war and accompanying uncertainty.

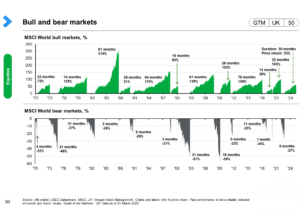

A bear market – so-called because bears hibernate – is a term used when an index such as the S&P 500 has fallen 20 per cent or more from a recent high for a sustained period of time. A surging market is referred to as a bull market.

Hold your nerve

Historically, it’s been shown that staying invested through the bad times will pay off long-term.

For example, if you were to stay invested in an FTSE All Share tracker fund over 15 years, you would have had a good average annual return of 8.18%. But if you tried to time the market and missed just the best 10 days, this would have the effect of reducing your investment return from 9.84% to just 4.72% each year. Missing the best 40 days would reduce your average annual return to just -1.49%. Remaining invested throughout the more volatile markets is usually the best strategy for long-term gains.

Maintaining a long-term perspective when times are tough can be difficult. But regardless of whether investments are in pensions, ISAs, or other accounts, it’s crucial to stay calm.

Selling stocks out of panic can cost you money, while keeping your investments in place gives the market time to recover. Avoid impulsive decisions based on short-term market movements and trust in the power of compounding returns over time. As investment analyst Kenneth Fisher famously remarked: “Time in the market beats timing the market.”

Investing during challenging times requires a thoughtful approach. By embracing diversification, focusing on quality investments, making the most of tax-efficient options, maintaining a long-term perspective, and seeking professional guidance, you can position yourself for success.

- Vanguard Asset Management (date to be confirmed from presentation)

- Kenneth Fisher, Executivechairman of Fisher Investments, quoted in an article for USA Today in 2018

Here to help

we believe that periods of uncertainty are where good financial planning is most valuable. Our experts will help you navigate market volatility, tailor investment strategies to your needs and goals, and help you remain focused on your long-term strategy.

If you have any questions or wish to explore your options, reach out to us. Our team of experts is ready to assist you. please don’t hesitate to contact us on 0333 241 3350 or email info@richmondhousewm.co.uk

The information available through Richmond House Wealth Management is for your general information. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Appropriate independent advice should be taken before making any such decision. Past performance is not necessarily a guide to future performance. The value of investments may go down as well as up and you may not get back the money you originally invested. Tax treatment depends. On individual circumstances of each client and may be subject to change in the future. The Financial Conduct Authority (FCA) does not regulate tax advice.

Richmond House Wealth Management is a trading name of IWP Financial Planning Limited which is authorised and regulated by the Financial Conduct Authority. Financial Services Register:441359 at register.fca.org.uk. Registered Office: Blythe Lea Barn Mill Farm, Packington Park, Meriden, Warwickshire, CV7 7HE. Company Number 04138186.